jersey city property tax calculator

Jersey City New Jersey and Dallas Texas. The assessed value is determined by the tax assessor.

Our Premium Calculator Includes.

. It is equal to 10 per 1000 of taxable assessed value. JERSEY CITY NJ 07302 Deductions. Jersey City Nj Property Tax Real Estate.

For comparison the median home value in New Jersey is 34830000. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return. Our Premium Calculator Includes.

Jersey City Property Tax Pay Online The current total local sales tax rate in Jersey City NJ is 6625. The median property tax on a 11820000 house is 171390 in Jersey County. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

This mortgage calculator will work for any property but was specifically designed for condos and lofts. Box 2025 Jersey City NJ 07303. Simply enter the first four fields to see what your principal and interest payment will be.

New Jerseys real property tax is an ad valorem tax or a tax according to value. Jersey city property tax calculator. Overall homeowners pay the most property taxes in new jersey which has some of the highest effective tax rates in the country.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street.

Online Inquiry Payment. Property Taxes - City of Jersey City Jersey City Real Estate Tax The Jersey City sales tax rate is. Two rivers title is licensed in nj ny pa ct md nc va and fl.

When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. The jersey city sales tax rate is. In Person - The Tax Collectors office is open 830 am.

If your property is located in a different Essex County city or town see that page to. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. Dont let the high property taxes scare you away from buying a home in New Jersey.

The standard measure of property value is true value or market value that is what a willing. The median property tax on a 11820000 house is 124110 in the United States. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Calculate your take home pay in Jersey thats your salary after tax with the Jersey Salary Calculator. The evaluation is a two step process. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Property taxes are the major source of funds for Jersey City and the rest of local governmental entities. In Bergen and Essex Counties west of New York City the average annual property tax bill is over 10000. A quick and efficient way to compare salaries in Jersey review income tax deductions for income in Jersey and estimate your tax returns for your Salary in JerseyThe Jersey Tax Calculator is a diverse tool and we may refer to it as the Jersey wage calculator salary.

The median property tax on a 11820000 house is 204486 in Illinois. When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. Jersey City Mortgage Calculator.

Starting with tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Union County. 11 rows City of Jersey City.

By Mail - Check or money order to. 2022 Cost of Living Calculator for Taxes. Voters in Jersey City have endorse new Property Tax design to fund the arts offering a boost to industry with many now out of work.

In nearly half of New Jerseys counties real estate taxes for the average homeowner are more than 8000 annually. TAXES PAYMENT 000 50000 000 0 000. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

The referendum which was voted on Tuesday along with a statewide decision about legalizing Marijuana received support from 64 percent of voters according to the New York Times. The average effective property tax rate in New Jersey is 242 compared with a national average of 107. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

General Property Tax Information. The average effective property tax rate here is 172 higher than any of Marylands counties. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and.

The median property tax on a 39720000 house is 750708 in New Jersey. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Jersey city property tax calculator Friday March 11 2022 Edit. Besides counties and districts such as hospitals numerous special districts like water and sewer treatment plants as well as parks and recreation facilities depend on tax money. City of Jersey City PO.

First fill in the value for your current NJ Real Estate Tax Assessment in the field below then select your County and City and press the Calculate button. If you enter less than 20 down the calculator will automatically add Private Mortgage Insurance PMI. The median property tax on a 39720000 house is 417060 in the United States.

National Trivia Day Question What Is The Smallest State In Square Miles In The United States Answer B Rhode Islan Plexus Products Plexus Worldwide Trivia

![]()

Become A Cardiovascular Technologist Or A Diagnostic Medical Sonographer Diagnostic Medical Sonography Sonographer Medical

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

New York Property Tax Calculator 2020 Empire Center For Public Policy

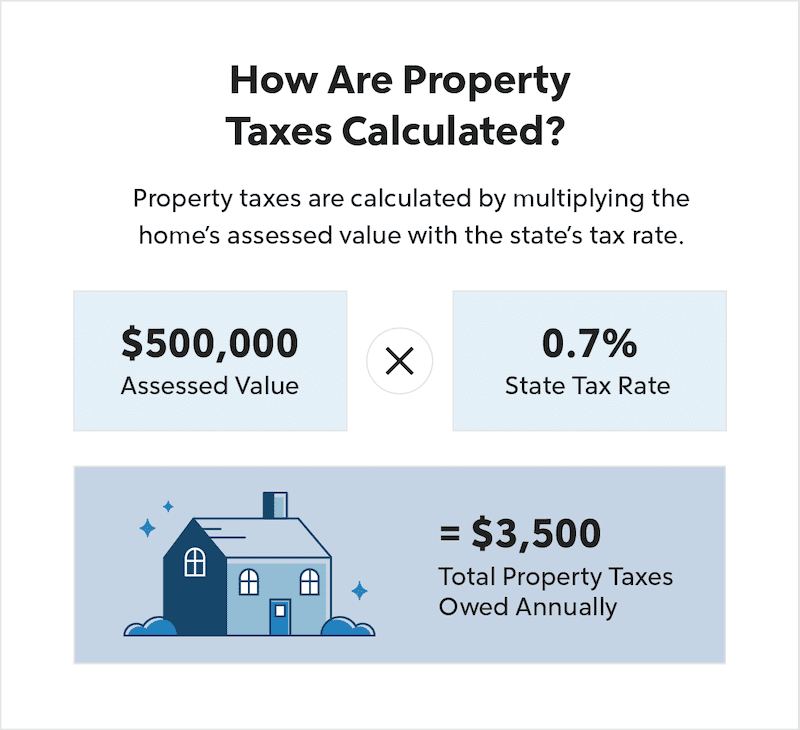

Property Taxes Calculating State Differences How To Pay

Township Of Nutley New Jersey Property Tax Calculator

106 Brookdale House Styles Property Real Estate

Loan Against Property Commercial Property Loan

Property Tax How To Calculate Local Considerations

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Tax Value Vs Market Value Allenhughesrealty Allen Hughes Realty Lakenorman Realtor Charlotte Home Value Calculator Market Value Home Ownership

Real Estate Taxes Vs Property Taxes Quicken Loans

Documentation For Loan Against Property What You Need To Know Tax Debt Relief Property Tax Tax Debt

The Average Lot Size Of New Single Family Homes Home Sell Your House Fast Home And Family

Mumbai Improves Property Tax Accountability Building Society Property Tax Ncr

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Township Of Nutley New Jersey Property Tax Calculator

Your Search For Real Estate Investment Properties Begins And Ends Here Use Analytics To Find Traditional O Investment Property Real Estate Investing Investing